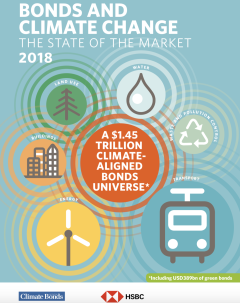

The first section of this report presents the findings of Climate Bonds Initiative’s research of climate-aligned issuers, conducted between April and June 2018. It identifies issuers who generate at least 75% of their revenues from ‘green’ business: low- carbon transport, clean energy, sustainable water and wastewater management, low- carbon buildings and built environment, sustainable forestry and agriculture, as well as waste management and recycling.

The second section of the report looks at the diversity of bond structures used in the green bond market. Features on different bond and securitisation types provide commentary on issuers and future prospects. It also includes an update on green bond policy covering 2017 and 2018, as well as a summary of the green bond pricing research conducted by Climate Bonds Initiative.

Key findings:

- USA, China and France are top three countries for labelled green bond issuance, followed by Supranationals, Germany, Netherlands, Sweden, Spain, Canada and Mexico.

- Fannie Mae is by far the largest green bond issuer with USD37.7bn of outstanding aligned volume, followed by the EIB – USD26bn and Kreditanstalt fuer Wiederaufbau (KfW) – USD15.2bn.

- If we exclude development banks, the French Republic Government Bond OAT takes the second place in the larget issuer league table at USD12.2bn, followed by Engie SA (USD7.8bn).

- Top sectors for green bond issuance are: Multi-sector (USD179bn), Energy (USD90bn) and Buildings (USD70bn).

- 498 green bond issuers with USD389bn of outstanding bond volume accounts for 32% of the climate-aligned universe.