This document considers the state of coal power alongside the long-term impact from COVID-19, with a focus on China.

The report suggests that COVID-19 will not fundamentally change the operating cashflows of coal power in the longer term. The impact of COVID-19 is limited, due to already suppressed coal prices and the insignificance of carbon pricing globally. However, the economic downturn caused by the outbreak risks loosening the planning process and environmental regulations for coal power investments in China.

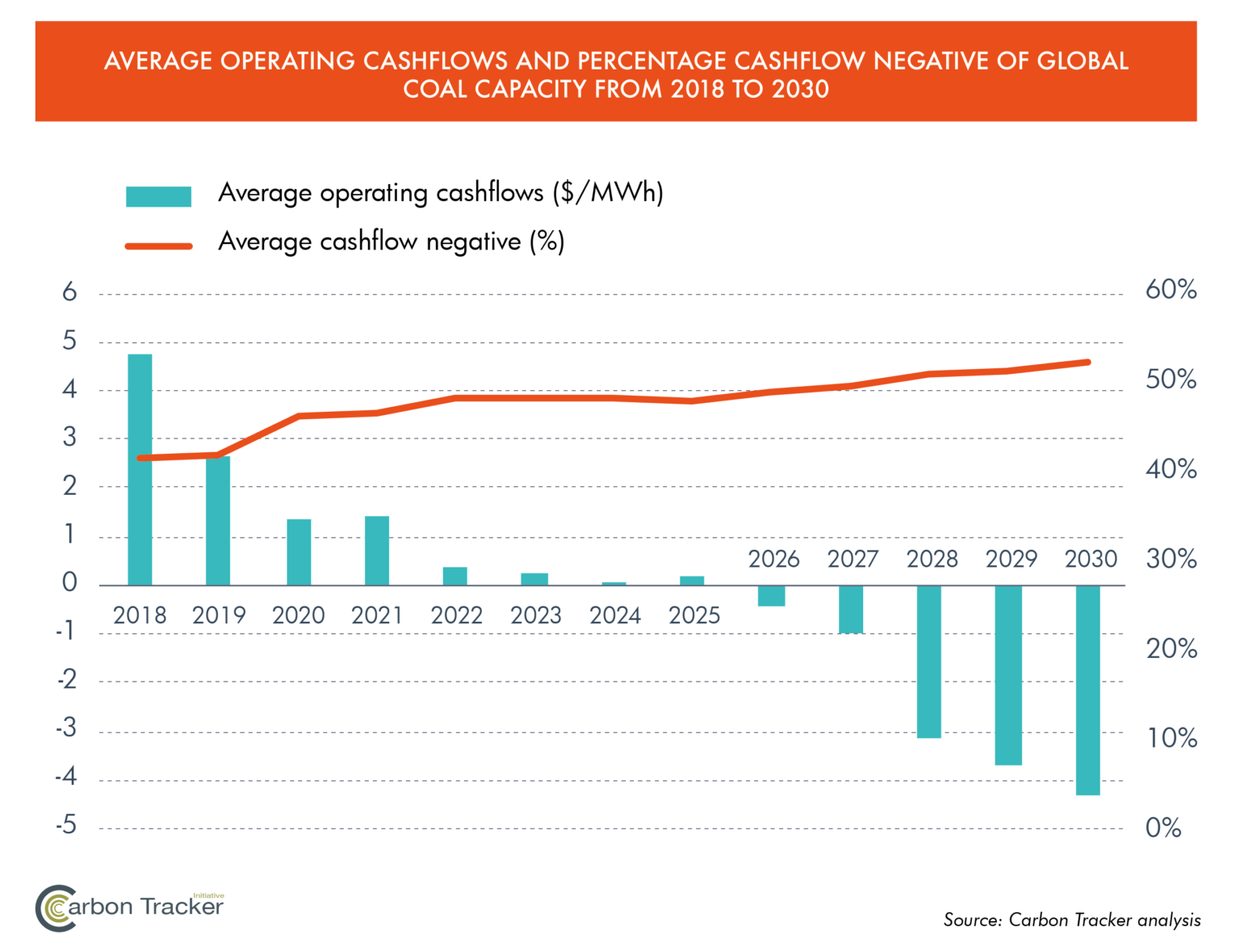

As a result, China and other nations could be burdened with uneconomic and climate unfriendly coal power energy for decades if they build new coal capacity to stimulate their economies in the wake of the COVID-19 pandemic. The report concludes by estimating that only 28% of the pipeline of coal power will enter the market cashflow negative, despite a recent publication showing new investments in renewables are already cheaper than new investments coal in all major markets, and a 2018 report predicting a steep increase in the share of coal capacity that is cashflow negative. This may be attributed to regulatory and policy structures that favour coal power.