This is a pivotal year for biodiversity, as countries are set to meet in December in Montreal, Canada, for the 15th Conference of Parties to the UN Convention on Biological Diversity (CBD COP15). The meeting will focus on creating biodiversity targets for the next decade as part of the post-2020 Global Biodiversity Framework. It will also focus on how to finance the protection and restoration of nature, with much debate around generating funds needed for nature while not stymying economic growth in developing countries.

In this area, the work of the United Nations Development Programme’s Biodiversity Finance Initiative (UNDP-BIOFIN) has demonstrated how developing countries can be trendsetters in delivering sustainable finance solutions for people and planet.

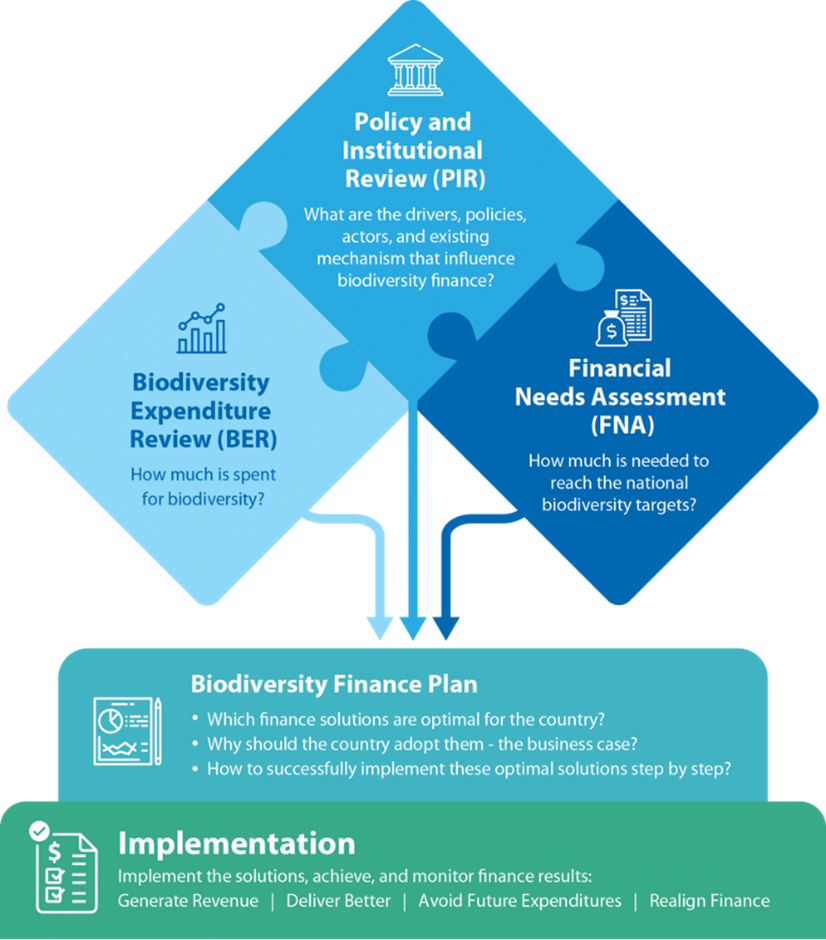

BIOFIN was initiated by the United Nations Development Programme (UNDP) at COP11 in 2012 in response to the urgent global need of finance for nature to reach global and national biodiversity goals. Now present in over 40 countries, BIOFIN is working with governments, civil society organizations, vulnerable communities and the private sector to catalyze nature-positive investments. Through an evidence-based approach, the initiative guides countries to develop Biodiversity Finance Plans.

These plans feature a host of biodiversity finance solutions tailored to a country’s own context, ensuring that the solutions are feasible and impactful – financially and for biodiversity conservation. Key to this is having a diversity of mechanisms available to provide the country’s nature with sufficient financial resilience, especially when facing obstacles such as a pandemic that could reduce other revenue streams, such as tourism.

BIOFIN has identified more than 150 biodiversity finance solutions that can be used to finance the preservation and restoration of nature in a country. In Africa, new solutions are helping put countries on a path towards a green recovery.

Biodiversity expenditure coding in Malawi

As the old saying goes, what’s measured is managed. To better manage biodiversity, BIOFIN analyses how much is spent for biodiversity conservation in each country through a detailed Biodiversity Expenditure Review. Without knowing what is being spent on biodiversity, and indeed on what is harming it, it is a challenge for governments to come up with thorough, evidence-based approaches for delivering biodiversity finance solutions.

To overcome such a challenge, biodiversity expenditure coding or tagging can be adopted. This is a tool that can bring a host of long-term benefits to a country, such as influencing more and better investments in biodiversity protection, improving the recording and monitoring of how public money impacts the environment, and helping biodiversity performance indicators track progress towards national and global biodiversity goals. Simply put, adding coding to expenditures for biodiversity means public departments must indicate if any of their spending is linked to nature. In turn, this allows the government to gather thorough intelligence on where public budgets are helping, and perhaps even harming, nature.

In Malawi, biodiversity expenditure coding was introduced in the public accounting system from 2022, which will increase the allocation of resources towards the protection and restoration of nature. This was based on a recommendation from BIOFIN’s Biodiversity Expenditure Review, which tracks spending on nature across different sectors.

Conservation revenue-generating opportunities in Botswana

More than 40% of Botswana’s land area is designated as national parks and game reserves, an important resource to the country and in global efforts to preserve nature and its related ecosystem services. Local communities depend on this rich source of nature, both in terms of the services it provides, such as clean water, and the money brought in by tourism.

an important resource to the country and in global efforts to preserve nature and its related ecosystem services. Local communities depend on this rich source of nature, both in terms of the services it provides, such as clean water, and the money brought in by tourism.

Park entry fees are one of the primary revenue-generating opportunities for conservation and for employing local communities. These fees were last reviewed more than 20 years ago, meaning one of Botswana’s most valuable sources of revenues was substantially lower than it could be.

A solution identified in the Botswana Biodiversity Finance Plan was to revise these fees. In close collaboration with the government, BIOFIN developed a business case detailing the need for review, which was approved by the government. A consultative approach to the process was chosen and after detailed stakeholder inputs, especially on the types of fees, criteria, structures and amounts, the new fees were approved for implementation in 2021 and put in effect in April 2022.

This solution is now being delivered across the country, generating more revenues for the government to reinvest back into sustainable economy.

Green bonds in Zambia

Zambia is a country that has faced significant biodiversity loss in recent years. BIOFIN is now supporting the government and the private sector with identifying innovative solutions to protect and restore nature, while supporting the economic development of the country. A green bonds framework has been created to not only protect biodiversity, but to help invest in innovative projects that will bring long-term benefits both to the planet and investors. The proceeds from these green bonds will be used to finance green-related national priorities as outlined in Zambia's various green growth policies and strategies. In September 2022, Zambia’s finance minister presented an exemption from withholding tax upon interest income earned on green bonds listed on the securities exchange in Zambia, with a maturity of at least three years to encourage investment in projects with environmental benefits.

Zambia has also recently passed a new bill to attract more local investment in nature-positive businesses across the country. The new bill reduces the minimum investment threshold from $500,000 to $50,000 to receive fiscal and non-fiscal incentives and therefore attract impact investors for small, local green investments.

Mapping biodiversity in South Africa

Mapping biodiversity in South Africa

South Africa is one of the first countries in the world to develop a spatial data tool that integrates priorities across biodiversity conservation, climate change and sustainable development into a single action map. This comes as a result of the partnership between UNDP-BIOFIN, the Impact Observatory and the Sustainable Markets Foundation, the Department of Forestry, Fisheries and the Environment (DFFE), and the South African National Biodiversity Institute (SANBI), whose aim has been to map the country’s essential life support action areas. These areas are key places where efforts to protect, manage and restore nature could sustain critical benefits to South Africans, including food and water security, sustainable livelihoods, disaster risk reduction and carbon sequestration.

A vision for a green recovery

The above examples are just a few of the 150 finance solutions that currently exist. They collectively demonstrate how developing countries are leading the way in creating and delivering innovative finance solutions.

The COVID-19 pandemic displayed the linkages between nature preservation and human health, but it also disclosed the fragility of certain finance streams protecting our nature.

The post-2020 Global Biodiversity Framework will set us up to take on this global biodiversity challenge, and evidence-based finance plans, like those developed by BIOFIN, will be critical tools to finance biodiversity and ensure we reach our global goals.

To learn more about the BIOFIN process, which is now being implemented in more than 40 countries, visit www.biofin.org