While Sovereign Wealth Funds (SWFs) hold total assets under management worth USD7.5 trillion and their potential role in financing and promoting green investments and the Sustainable Development Goals (SDGs) is undeniable, so-called green investment by these funds has barely been explored.

What are Sovereign Wealth Funds?

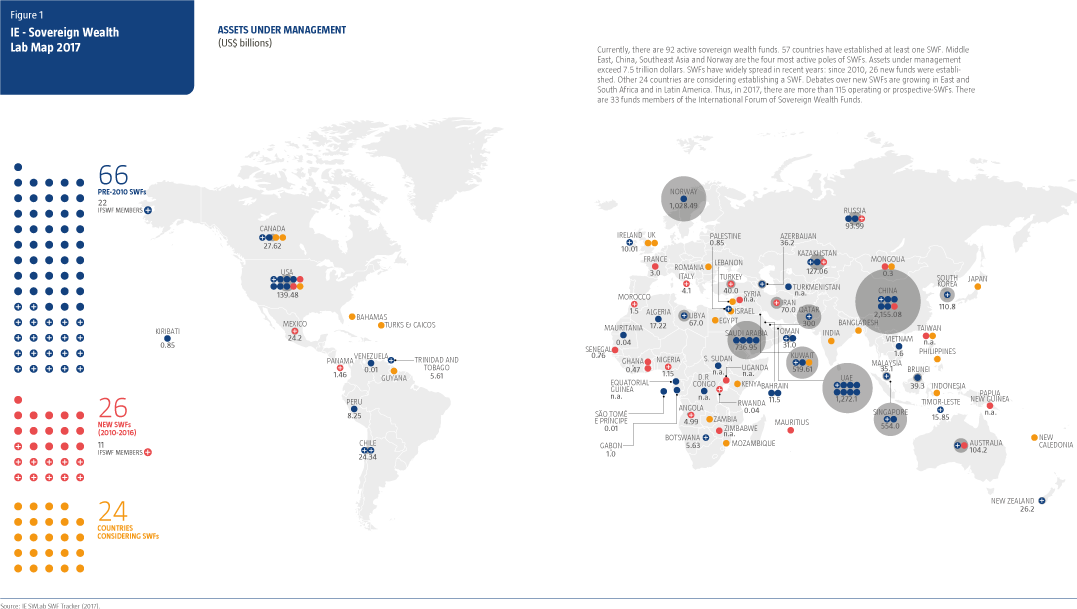

SWFs are government-owned investment funds with long-term investment strategies without pension liabilities. SWFs derive their wealth mainly from natural resources and foreign-exchange reserves. Their purposes vary from fiscal stabilization, and intergenerational saving to pension reserves and economic development. Around the world, there are 92 funds in operation in 57 countries (see Figure 1). Most SWFs are located in developing economies where natural resources such as oil or natural gas are found. In 2012, SWFs invested just 9% of assets in private markets. At the end of 2017, this figure had risen to 30% in search of stable and higher investment income from real estate or infrastructure. The remaining 70% of SWF assets are distributed between fixed income (30%) and listed equities (40%). The recent and significant growth of real assets in SWF portfolios has increased in-house capabilities, leading to a stronger alignment between SWF portfolios and long-term investment horizons. This exposure to real assets, and the fact that SWFs invest in long-term horizons, mean there is real potential for SWF involvement in green investments in the future. After all, is there any longer-term asset than our planet?

Figure 1: World Map of SWFs (Source: Capapé, J., & Santiso, J. (Eds.) Sovereign Wealth Funds (2017) Madrid: IE Business School and ICEX)

How green are SWFs in developed and developing countries?

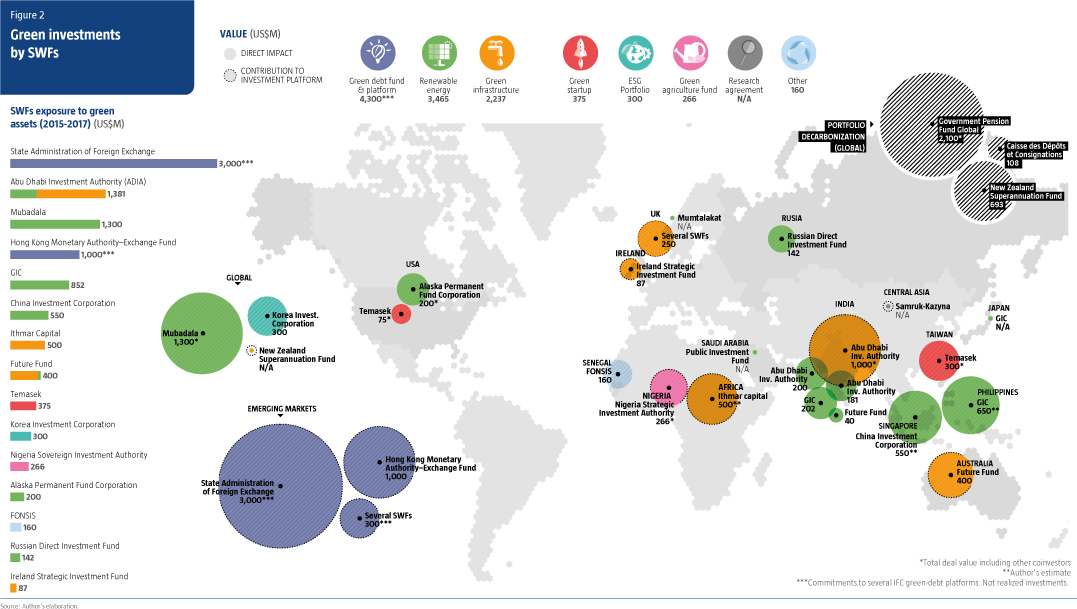

Over the last three years, the total value of green investments by SWFs has risen to USD11 billion. While this is a tiny fraction of the total assets of the SWF industry (less than 0.15% of its total assets), it represents almost 8% of total SWF direct investments in the 2015-2017 period, indicating a growing interest in renewable energy companies, green infrastructure funds and clean energy start-ups (see Figure 2).

Pioneered by the United Kingdom’s Climate Change Act in 2008 and France’s influential Energy Transition for Green Growth Act in 2015, developed countries typically promote climate-related investment strategies through legislation. SWFs from these countries tend to focus on portfolio decarbonisation strategies.

In the past 18 months, SWFs from Norway, New Zealand and France have divested their portfolios from companies with high levels of GHG emissions –valued at USD2.9 billion. Yet, it is important to note that only the Government Pension Fund Global from Norway and the New Zealand Superannuation Fundhave fully integrated climate risks in their investment processes and strategic asset allocations.

SWFs from emerging and developing economies, such as the United Arab Emirates (UAE), Morocco, Singapore, China and Saudi Arabia, are investing in green infrastructure assets directly or via commitments on green infrastructure funds. However, there is a need to incorporate climate-specific strategies into the investment process.

Overall, SWFs invest in green assets by committing to green debt platforms (USD4.3 billion), investing in renewable energy companies and projects (USD3.5 billion) or participating in green infrastructure funds (USD2.2 billion). They have also backed start-ups that provide energy efficiency solutions, produce meat-free burgers and develop lab-grown leather.

Figure 2: Green investments by SWFs (Source: Capapé, J. (2017) Sovereign Wealth Funds: Sustainable and active investors? The case of Norway. In Capapé, J., & Santiso, J. (Eds.) Sovereign Wealth Funds (2017) Madrid: IE Business School and ICEX)

SWFs show huge potential, so what’s stopping them?

In fact, SWFs are well equipped to invest in green assets. With higher exposure to private and unlisted markets than other institutional investors, many SWFs are ready to invest heavily in long-term assets such as infrastructure, including green infrastructure.

SWFs are also increasingly paying attention to emerging markets, which represented 30% of all infrastructure investments at the end of 2017. At the same time, most of the financing gap to accomplish the SDGs, estimated to be between USD2.5 trillion per year to 2030, is related to infrastructure and clean energy, particularly in developing countries.

- Uncertainty of green portfolio performance

- Weak political demand

- Costs of carbon footprint analysis

Outbreaks of (green) hope

There is hope for a change in SWF investment strategies with several recent initiatives intended to integrate climate risk as a long-term financial risk. These include the development by the Financial Stability Board of consistent climate-related financial risk disclosures for companies to provide information to investors, lenders, insurers and other stakeholders. This will help large investors, including SWFs, to measure their carbon footprint and to establish portfolio decarbonisation strategies.

To execute a change in risk management, it will be necessary to revisit the long-term mission of SWFsto better understand the need to reconcile a long-term investment horizon with long-term climate-related risks and opportunities.

A strong will for change is exemplified by the launch of the One Planet SWF Working Group in December 2017. Led by four SWFs from the Middle East, Norway and New Zealand, and supported by the International Forum of SWFs (IFSWF), the Working Group plans to establish an Environment, Social and Governance framework to address climate change issues, including methods and indicators. While still in the nascent stage, this initiative shows the interest SWFs have around climate issues and indicates a growing momentum in this regard.

If SWFs can integrate climate change as a key element of their long-term investment strategy, it could help to bridge the financing gap for delivering the SDGs, especially in developing markets, where most SWFs are established.

Originally posted by Green Fiscal Policy Network