While the world needs to invest massively in renewable technologies, such as solar or wind energy, to address climate change and the growing demand for energy, the key actors of this transition - small innovative cleantech companies - are having a hard time to get funded.

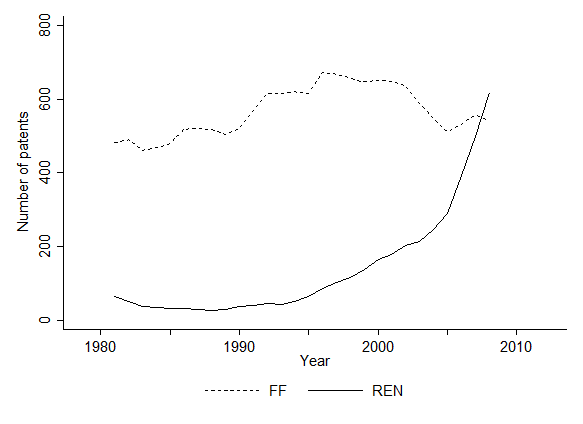

Today, fossil fuels still largely dominate energy markets. Adding up investments in exploration, extraction, oil refining and transport, fossil fuels represent 70% of global investments in energy markets, against 9% for renewable energy. Yet, the last years have witnessed a boom in investments in renewable energy. According to UNEP (2016), global investment in renewable power capacity was at $265 billion in 2015, more than double the amount invested in new fossil fuel capacity that year. R&D investments in renewable energy are also rising. Figure 1 shows the remarkable increase in patents in renewable energy over the last fifteen years rapidly catching up with the level of fossil-fuel patents as shown in Figure 1.

Source: Noailly and Smeets (2015). Owns calculations based on a sample of 5,000 firms filing patents in Europe.

Underlying these trends are sizeable changes in the landscape of energy markets as much of the recent dynamism and innovation in renewable energy markets is coming from smaller market players and new entrants. Much of the recent surge in patenting activities observed in Figure 1 is for instance explained by the entry of small firms innovating in renewable energy since the mid-1990s. Instead, the traditional large incumbent firms in the energy sector continue to massively patent inventions in fossil fuels, and only occasionally so in renewable energy (Noailly and Smeets, 2015).

The key role of small innovating cleantech firms creates new challenges for channelling investments towards renewable energy as these players tend to find it difficult to get funded. Firms active in renewable energy tend to be relatively small, both in the R&D and deployment stage, and do not have an institutional track record to secure debt financing. Instead, fossil-fuel firms are often large incumbent firms that can easily channel external finance.

Recent research by my co-author and myself at the initiative of European Investment Bank confirms this reality. Looking at the balance sheets of 1,300 European firms patenting in renewable and fossil-fuel technologies over the 1985-2009 period, we find that small innovating firms specialized in renewable technologies face important financial constraints: their patenting activities are more sensitive to a shock in cash flows than other firms, suggesting that they mainly rely on internal finance to fund R&D. By contrast, other firms innovating in fossil-fuel technologies are less financially constrained and can more easily resort to external financing (debt or equity). Interestingly, the results are not explained by the fact that firms innovating in renewable energy may be smaller or younger than firms specialized in fossil fuels but seem rather due to the specificity of renewable technologies.

Why are renewable technology firms different? First, most renewable technologies are still in an early stage of development compared to fossil fuels, and failure rates are still high. Second, there might be technical specificities which explain why renewable technologies present higher technological risks than traditional fossil fuels. Renewable technologies for instance usually require higher upfront capital investments than fossil fuel technologies. Most importantly, renewable technologies are still highly dependent on public support, since in the absence of stringent climate policies and carbon pricing, firm have little incentives to invest in clean technologies. Yet, the risk that policies supporting clean energy are subject to change makes it challenging for investors, especially for private equity investors who might hold an investment under successive governments.

So, how do we unlock finance to ease the financing constraints of small innovative cleantech companies? Governments and public investment banks have a key role to play in configuring investment policies to steer investments towards renewable technologies, for instance in the form of specific capital grants, venture and equity funds or low-interest loans for starters in clean energy. The boom of Fintech – short for financial technology - may also help to spread new financial instruments that may be better adapted to small renewable energy firms and the more diverse and small-scale nature of these projects. But, most importantly, attracting private investors to massively invest in renewable energy will require a consistent and stable policy framework committed to long-term climate policies and carbon pricing. Only such a concerted effort to reduce political and regulatory uncertainty can bring investors back to the table. Although the Paris Agreement provided a good signal in this direction, the recent election of climate-change-skeptic Donald Trump has thrown further uncertainty into the profitability of investing in renewable technologies, with many renewable energy stocks cratering the day after the election.

So, what will the future of global investments in renewable energy look like? Are renewable technologies already mature enough to attract a continuous stream of investors? Or will investors withhold undertaking new investments until the future of climate policy becomes clearer?