The biocontrol industry is expanding rapidly, but needs more supportive financing and policy frameworks. At the Annual Biocontrol Industry Meeting (ABIM) 2025 in Basel, Switzerland, the sector presented itself as an increasingly mature and poised for scale. Yet, even as scientific innovation remains strong, the industry is increasingly defined by challenges of scale, data quality, regulatory expectations and the financing structures needed to support growth.

Similarly, at the 8th World Congress on Rural and Agricultural Finance in Mombasa, Kenya, central bank representatives from Africa, Latin America and Asia highlighted ambitious national-scale public finance mechanisms, which demonstrate that central banks and finance ministries are beginning to recognizing their role in creating dedicated financing pathways to drive adoption and sector growth.

The Financing Agrochemical Reduction and Management (FARM) programme recognizes its role in connecting investors and innovators, laying the groundwork for stronger collaboration between the financial and biocontrol sectors to scale regenerative, low-chemical solutions and bring safer practices to market.

From the FARM perspective, several themes have emerged that capture both the opportunities and ongoing challenges in scaling safer, more sustainable crop protection solutions. These five takeaways reflect the industry's direction and potential.

1. Biocontrol R&D diversity and expanding solutions underscore the sector’s strength

The scope of biocontrol research and development (R&D) has expanded significantly. Presentations and exhibition discussions at ABIM 2025 showed how innovation in the sector continues to diversify, with companies showcasing:

- new microbial strains with increasingly specific modes of action

- biochemicals designed for targeted uses

- formulation improvements intended to address shelf-life and stability constraints.

Rather than emphasizing disruptive breakthroughs, current industry momentum reflects steady technical progress and a collective effort to build a range of more reliable, field-ready products. This broadening pipeline aligns with FARM’s view that no single solution can replace hazardous pesticides; scaling safer practices will require a mix of tools adapted to different crops, climates, and farming systems.

2. Corporate venture capital underpins biocontrol’s growth, but institutional investment must expand

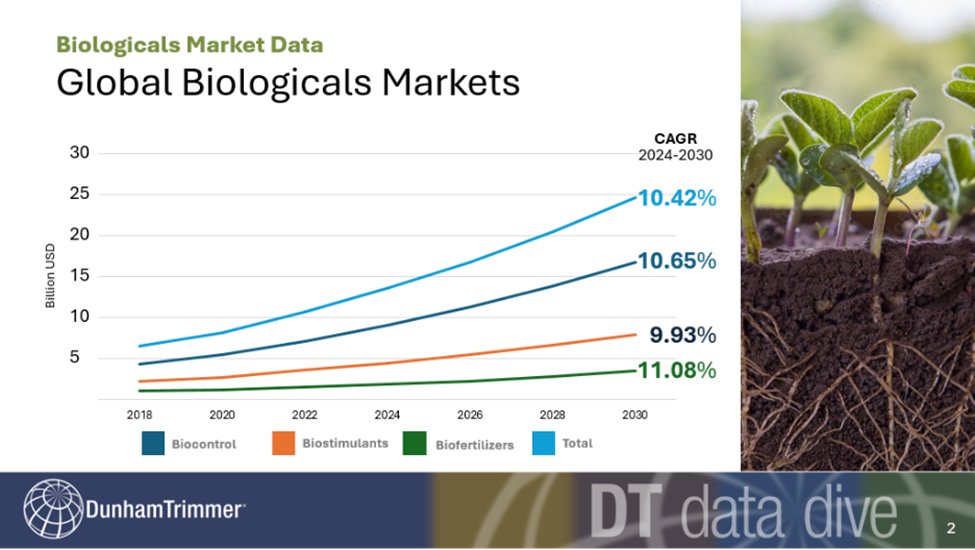

The flow of capital into biocontrol is now a structural feature of the agricultural market, driven by both corporate venture capital (CVC) arms and increasingly broader institutional investors. The sector is showing a consistent Compound Annual Growth Rate (CAGR) in excess of 10%.1

Sustained investment is critical as the industry scales and requires substantial capital for formulation, product stability, regulatory approval and manufacturing scale-up. The transition from synthetic pesticides to biocontrols will be gradual and will likely require incentives, capacity building and training.

Public finance can help create an enabling environment and de-risk private investment. For example, Thailand’s Bank for Agriculture and Agricultural Cooperatives (BAAC) offers special low-interest loans to farmers adopting bio-economy and green farming models2, while the Central Bank of Bangladesh directs green refinance schemes to expand access to biocontrol products and integrated pest-management (IPM) practices3.

Central banks can use their regulatory and supervisory powers to support the growth of low-pollution biocontrol alternatives, for instance, by encouraging the development and application of sustainable finance taxonomies that explicitly classify and favour financial assets tied to regenerative agriculture and biocontrol production, thereby channeling capital away from high-polluting practices. Interest in blended finance is accelerating as a way to mobilize private capital and close the funding gap for climate change mitigation and adaptation. Integrating biocontrols into these instruments is essential to ensure they effectively meet their intended climate targets and reduce reliance on hazardous chemicals.

3. Data science, digital finance platforms and operational AI technologies are essential infrastructure

Recent discussions around advanced computational methods, including machine learning and artificial intelligence (AI), focused on their practical application in operational technology development and in-field activities. Experts noted that, when responsibly developed and used, these tools are improving efficiency in biocontrol product development, for example, by:

- accelerating the identification of viable biological candidates

- optimizing complex formulation matrices to extend product shelf-life

- enhancing the precision of application through improved forecasting models and delivery mechanisms.

The emphasis was on data utility for solving concrete production and logistics challenges. AI also offers promise for innovations in the development and roll-out of digital finance platforms:

- Delivery mechanisms: that act as centralized hubs where farmers can access tailored information, remote sensing data, weather forecasts and agronomic advice.

- Market access: crucial for connecting farmers to the supply chain, such as e-commerce platforms for buying seeds or selling produce, or blockchain platforms for traceability.

- Data integrators: processing data from various technologies (IoT sensors, drones, satellite imagery) and farmer engagements to provide actionable insights for decision-making.

The Co-op Bank Soko platform4 is an example of an accessible, efficient and transparent digital marketplace launched by the Co-operative Bank of Kenya in partnership with Mastercard and Rabobank, providing farmers with access to finance, curated farm inputs and services. Having onboarded over 1 million farmers, the platform provides the scale and scope that can facilitate effective disbursement of targeted, transformative finance to smallholder farmers.

4. Align scientific value with financial metrics to strengthen investor confidence in biocontrol

A recurring theme across industry dialogues is the difficulty of linking scientific performance and biocontrol potential with financial decision-making. Financial institutions often lack the data, tools and expertise to assess biocontrol opportunities, while the industry needs to build clearer, financially aligned business cases to attract investment. Many companies present strong technical data, but investors and financial institutions continue to look for evidence of long-term, predictable returns and a clearer demonstration in terms of:

- quantified return on investment for farmers and financiers

- risk mitigation compared to hazardous pesticide use

- scalability and knowledge of the market

- alignment with ESG criteria, sustainability taxonomies and disclosure rules

- benefit-cost ratio that accounts for the rewards of improved health outcomes, soil security, clean water and biodiverse ecosystems.

Closing the gap between scientific demonstration and financial due diligence remains a priority activity of the UNEP Finance Initiative, in partnership with FARM. This work includes: developing and piloting sector-specific guidance for Principles for Responsible Banking (PRB) member banks to reduce agrochemical pollution;5 identifying the structural and operational features needed to replicate and scale blended finance solutions that de-risk and attract private capital; and strengthening corporate sustainability disclosure standards so financial institutions have consistent, verifiable data to align portfolios with sustainability goals and unlock private investment in low-chemical practices.

Notably, the 2025 update to the UNEP FI Accountability for Nature report is the first to include a specific section on pollution, including chemical pollution.6

A sector-specific guidance for financial institutions, including banks and insurers, is also forthcoming to help manage pollution risks and promote low-chemical alternatives. FARM also seeks to offer support to private financiers, enabling them to pilot the guidance and provide technical assistance aimed at mobilizing private capital for sustainable farming practices.

5. FARM plays a key role in supporting dialogue between innovators and finance

Developments in the biocontrol sector create an opportunity for FARM to help convene finance, regulators, innovators and value chain actors to ensure that biocontrol and regenerative solutions are not only conceived and funded, but effectively delivered, widely adopted and scaled across the agrifood system.

As the biocontrol sector continues to evolve, the strategic alignment of innovation, policy and finance will be vital to accelerating the global transition towards low-chemical, regenerative agriculture, an ambitious shift that FARM is committed to championing and supporting every step of the way.

This article is part of the publication of the FARM programme. Funded by GEF and led by UNEP, it aims to reduce the use of harmful pesticides and plastics in agriculture by shifting policies, practices and investments towards sustainable solutions that safeguard ecosystems, human health and food security. Be part of the change: gef-farm.org.

Author: Dr Benjamin Warr, Private Finance Lead, FARM Global

Co-author: Dr Alison Watson, Agrifood Expert, FARM Global

Contributors: Helena Rey, FARM Global Project Manager; Peggy Lefort, Pollution & Resource Efficiency Coordinator, UNEP FI; Nadya Pryana, Knowledge Management & Research Specialist, FARM Global

--

1Referenced from the presentation by Mark Trimmer, President & Founding Partner at DunhamTrimmer LLC, at the “Biocontrol Meets Finance” session at the Annual Biocontrol Industry Meeting 2025, 22 October in Basel, Switzerland. The Annual Biocontrol Industry Meeting (ABIM) is hosted by ABIM AG, a jointly owned venture of the International Biocontrol Manufacturers Association (IBMA) and the Research Institute of Organic Agriculture (FiBL).

2BAAC moves forward with its mission to become the centre of agriculture by using technology along with data management to create strength for both the bank and its customers (2024, November 15). Money & Banking. Retrieved from https://en.moneyandbanking.co.th/2024/140558/

3Bangladesh Bank. (n.d.). Bangladesh Bank. Retrieved from https://www.bb.org.bd/en/index.php

4ICA Africa. (2022). CoopBank Soko. Retrieved from https://icaafrica.coop/sites/default/files/2022-04/CoopBank%20Soko.pdf

5UNEP FI. (2024). Navigating pollution: A blueprint for the banking sector. Retrieved from https://www.unepfi.org/industries/banking/navigating-pollution-a-blueprint-for-the-banking-sector/

6UNEP FI. (2025). Accountability for Nature (Version 1.2). Retrieved from https://www.unepfi.org/wordpress/wp-content/uploads/2025/02/Accountability-for-Nature_V1_2.pdf