On 24th June, UNEP's Inquiry released its first publication, “Aligning the Financial System with Sustainable Development”. It sets out an open invitation to those with interests, experience and insights to contribute to developing design options for a sustainable financial system. The occasion for releasing this Invitation was the day-long Finance Symposium held in Nairobi as part of the first, landmark meeting of the United Nations Environment Assembly. Organized in association with the UNEP Finance Initiative, the Symposium brought together Environment Ministers, with senior executives from the financial community and leading international experts.

The Inquiry has made good progress in its first 150 days. The Invitation sets out the results of its initial mapping, drawing on insights from the Advisory Council, initial research commissioned, and the work of key partners, particularly the UNEP Finance Initiative. It highlights a pattern of emerging policy innovations mainly from emerging markets, which aim to bring investment into a better alignment to meet the needs of the real economy. The Invitation provides some key conceptual and definitional building blocks that will help to systemize the scope of the Inquiry, which is covering banking, including credit creation and monetary policy, investment and insurance.

The Inquiry is focused on country-level challenges and policy innovations. In Bangladesh, for example, the Inquiry has initiated a study of non-traditional approaches to monetary policy with the Central Bank, overseen by its Governor, Dr Atiur Rahman, an Inquiry Council member. In South Africa, a cluster of investor and corporate governance innovations is being explored with support from the Global Green Growth Institute, and the Johannesburg Stock Exchange led by CEO, Nicky Newton-King, another Council member. And Murilo Portugal, Council member and President of Febraban – the Federation of Brazilian Banks, is partnering with the Inquiry in exploring policy and governance innovations that have brought environmental stewardship closer to investment decision-making. Meanwhile, the Inquiry is working with the International Institute for Sustainable Development and the Fridjof Nansen Institute in exploring and developing China's interest in green financial policies and regulations with the Finance Institute of China’s Development Research Center of the State Council.

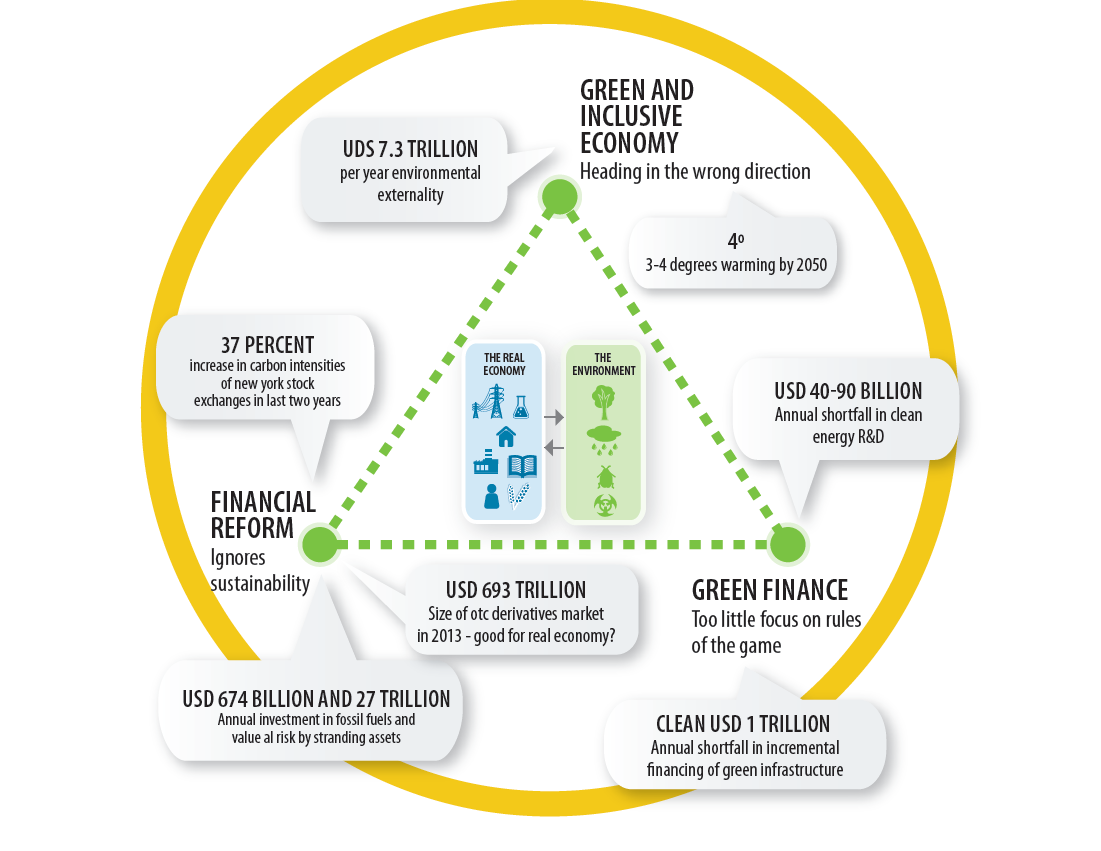

The Inquiry is taking place at an historical “moment in time”, when it is increasingly recognized that private capital is crucial to financing the transition to an inclusive, green economy, and that post-crisis financial market reforms have not taken account of critical environmental and equity challenges and opportunities.

Sustainable financing has been advanced by some exemplary, innovative financial institutions. Yet as Achim Steiner, Under-Secretary-General and Executive Director of UNEP says in its opening pages, “…individual investors, however large, can only do so much...Crucially, the recent economic crisis has highlighted the importance of the overall functioning of the financial system in determining what it does, and does not, invest in”. Dr. Shamshad Akhtar, United Nations Under-Secretary-General and Executive Secretary of the United Nations Economic and Social Commission for Asia and the Pacific, has recently called for greater alignment of the financial markets to the needs of sustainable development in the context of the work of the Intergovernmental Committee of Experts on Sustainable Development Financing.

Such a view in past years might have been seen as radical and perhaps implausible. Yet today, there are growing calls for such change. Mark Burrows, Managing Director of Credit Suisse, Asia Pacific, for example, has recently argued that:

“What is needed is not just money. What is really needed is the political will to correct market failure by rethinking parts of the financial system…the metrics, institutions, and policies that govern how financiers and investors evaluate economic activities”.

Such views resonate with civil society calls for change. Kumi Naidoo, Executive Director of Greenpeace International, has made essentially the same call for change:

“We must question the prevailing logic of …a financial system that essentially rewards unemployment and consolidates a notion of jobless growth… that rewards rampant over-consumption rather than grappling with the more complex challenge of sustainable development.”

The Invitation opens the Inquiry’s doors to open dialogue, an essential step in bringing the core topic of financial market development into broader public and policy debate. Deepening engagement with specialist organizations such the Bank of International Settlements, the IMF and the World Bank is critical. Equally important, however, is engagement with civil society and the labor movement, national policy makers and regulators, and the wider business community.

The Inquiry’s Invitation comes in varied, physical forms.

- For the hurried reader, there is a suite of two-page briefings, offered in multiple languages.

- For those with a little more time to spare and an interest in the underlying issues and arguments, there is a 20-page summary in English that will also be launched in Mandarin at the Eco-Forum Global on the 10th July in Guiyang, China.

- And finally, for those focused on the more technical end of the Inquiry's work, a more detailed, 60 page, English-language discussion paper.

About 25% into its 24-month lifespan, the Inquiry is still a long way from reaching any conclusions let alone setting out policy options. That said, the Invitation does highlight some of the more promising emergent innovations that might provide guidance for future policy options in shaping a sustainable financial system. Moreover, the Invitation sets out some core questions that need to be wrestled to the ground over the coming months, from the fundamentals of future-time discounting of economic benefits to the mandates of, and methods adopted by financial regulators in the context of long-term environmental impacts and sources of systemic risk.

Aligning the financial system to the needs of the green economy is a pre-condition for sustainable development. The Inquiry’s contribution to achieving this alignment depends on its success in mobilizing the practical knowledge and inspired leadership needed for policy and market practitioners to make the changes needed. The Invitation to participate sets out and exemplifies this approach and will hopefully help to catalyze many into action.

Simon Zadek and Nick Robins are co-Directors of the UNEP Inquiry into Design Options for a Sustainable Financial System and can be contacted at simon.zadek (@) unep.org and nick.robins (@) unep.org.