With the endorsement of a resolution on Sustainable Management of Natural Capital for Sustainable Development and Poverty Reduction during the recently held United Nations Environment Assembly in Nairobi, Kenya, a new era of correcting the compass to measure sustainable human well-being has begun.

Conventional income (the market value of output during a fixed period in a given region) has been treated as a proxy for human well-being for too long. The limitations of the system of national accounts – where pollution abatement activities show up as income and biodiversity loss goes unnoticed – are becoming better understood.

From an environmental sustainability perspective, traditional income measurement is defective because it only partially treats natural capital stock in its coverage. While wealth (and natural capital) is a stock, income is a flow (a return on wealth). Understanding this difference is critical. Conventional GDP is adept at measuring flow, but it can only partially measure wealth.

GDP can capture net financial assets, physical assets, partial human capital (e.g. intellectual property) and up to a point the commercial component of natural capital (fish, timber). It has great difficulty in capturing and measuring the physical aspects of natural capital like ecosystem services, let alone their economic value. Most existing valuation in accounting processes relies heavily on exchange/transaction values, where there is no measure in place to capture what economists and ecologists call ”environmental externalities” (the depletion and degradation of natural capital).

It is not surprising that conventional wisdom – that resource allocation based on robust income estimates brings about a balance in the economy, including in the production, distribution and consumption of resources – has failed terribly. Today, we, the global population, are each emitting about five tons of carbon per annum into the atmosphere; a quarter of global land has been degraded since the beginning of the 21st century; and biodiversity is declining at an alarming rate. Tropical forests are continuing to be cleared for crops, and overfishing continues to damage marine ecosystems causing a collapse in fish stocks.

Economists have been warning about these types of anomalies for a long time. More recent thinking – such as in Beyond GDP, Potsdam 2007, the G8+5 Initiative, The Economics of Ecosystems and Biodiversity (TEEB), Wealth Accounting and Valuation of Ecosystem Services (WAVES), and the Stieglitz/ Sen/ Fitoussi report, along with the Inclusive Green Economy Initiative – highlights the need to look for better measurements of changes in human prosperity.

The error of equating income with well-being can be rectified if the accounting profession pays attention to wealth (stock) measurement in an inclusive/comprehensive manner. Here it may be remembered that while writing An Enquiry into the Nature and Causes of the Wealth of Nations, Adam Smith was referring to wealth, not income. Even today, multilateral institutions consider the wealth of a nation, not its income, before extending any financial help, and don’t accept poor quality balance sheets.

UNEP, with others, has been working on this. The Inclusive Wealth (IWR) Report 2014 emphasizes the need to measure man-made, human and natural capital. The methodology and data can easily be extended to social and cultural capital. The report analyses 140 countries over the past 20 years. (The forthcoming 2016 report aims to do this for over 170 countries). Using this tool, countries are able to envision how their holistic wealth components have evolved over time. Country capacities can continue to be built as new breakthroughs in calculating and reporting on the Independent Wealth Index (IWI) are developed.

IWR 2014 suggests that produced capital, as measured by GDP, represents only about 18 percent of the total wealth of nations.

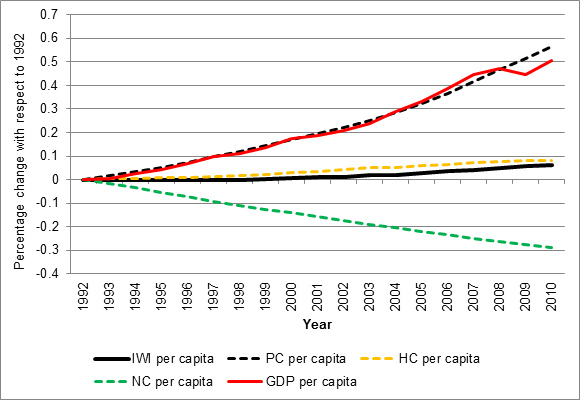

While there have been increases in GDP and the Human Development Index, natural capital actually declined in 127 out of 140 countries between 1990 and 2010, according to IWR. Worldwide, while GDP rose by 50 percent from 1992 to 2010, IWI rose by only 6 percent. This is because in the wider ambit of sustainable development GDP fails to account for sources of wealth such as nature and human progress, which are covered by IWI.

Assessing and valuing natural capital and the change in per capita inclusive/comprehensive wealth over time has the potential to keep track of progress on most Sustainable Development Goals (SDGs).

IWI is a multi-purpose, multi-target measure of sustainable development. An increase in IWI will indicate poverty eradication (SDG, 1) and food security, while promoting sustainable agriculture (SDG 2) and healthy lives and well-being (SDG 3). An increase in IWI will also show sustained and inclusive economic growth (SDG 8), and sustainable consumption and production patterns (SDG 12). A decrease in IWI will indicate degradation of natural capital and failure to take steps to combat climate change and its impacts (SGD 13), conserve and sustainably using the oceans, seas, and marine resources (SDG 14), protect, restore, and promote the sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, reverse land degradation and halt biodiversity loss (SDG 15). IWI can measure the strength of the means of implementation for sustainable development (SDG 17).

Countries cognisant of their stock of natural capital through IWI can invest in the protection and restoration of natural capital. IWI is a macroeconomic tool that enables policymakers to understand the trade-offs of different scenarios and policies. For example, Brazil, which has 56 per cent of its land under forest cover, experienced a decline in its forest wealth from 1990 to 2000. However, it was able to reverse this trend between 2000 and 2010 due to its conservation policies, the strict enforcement of forest laws, and by discouraging agricultural expansion in forest lands. (IWR, Ch. 6, p153).

IWI complements GDP as a multi-purpose indicator. It is capable of tracking stocks of wealth in human, natural and produced capital. IWI lends itself to monitoring and reviewing progress towards the SDGs.

IWI has a specific role to play in complementing SDG Target 8.1 which is currently measured by GDP growth with a target of 7 per cent per year (a measure of growth in the level of transactions). IWI complements this by emphasizing the growth of wealth – something that is much better aligned with the SDGs. A reasonable target for IWI would be to grow stocks of wealth at a global average of 3-5 per cent per year, though actual targets in some countries could be more ambitious.

Want to learn about the ecosystems approach? An online learning opportunity is coming up in September.

This blog was originally posted on unep.org.