The Green Growth Knowledge Partnership (GGKP) Expert Group on Natural Capital explores state-of-the-art methods, models, data and tools to achieve its three main goals: pushing forward the knowledge frontier around natural capital and green growth; mainstreaming natural capital in global green growth activities; and supporting stronger implementation of natural capital commitments in national economic plans.

In 2021, the expert group positioned itself as a strong partner in mainstreaming natural capital approaches in infrastructure and development finance, particularly in Africa. With its natural capital gap methodology and its expansion into assessing financial investment needs in filling the gap, the group also gained a strong momentum on the importance of investment in natural capital for sustainable development.

In addition to organizing a number of online meetings and knowledge-sharing events, a new online expert group was created to enable members to be more adaptive to the COVID-19 pandemic situation. Such a group brings a diverse range of additional experts, especially those on development finance and from multilateral development banks.

Follow the group's evolution through the links below:

Mainstreaming natural capital African development finance

On 9 September, the GGKP – together with the African Development Bank (AfDB) and World Wide Fund for Nature (WWF) – launched Natural Capital for African Development Finance (NC4-ADF). At the launch, high-level speakers from government, financial institutions and international organizations provided insights on embedding nature into development finance decision-making, which is essential to tackling the global climate and biodiversity crisis and engendering a green recovery from the global pandemic.

On 9 September, the GGKP – together with the African Development Bank (AfDB) and World Wide Fund for Nature (WWF) – launched Natural Capital for African Development Finance (NC4-ADF). At the launch, high-level speakers from government, financial institutions and international organizations provided insights on embedding nature into development finance decision-making, which is essential to tackling the global climate and biodiversity crisis and engendering a green recovery from the global pandemic.

Key results from the Tanzanian Kakono Hydropower Plant study, the first application of a natural capital approach on an infrastructure finance project, were presented to provide important considerations for integrated and sustainability-aligned infrastructure investment decisions on hydropower plants, which can serve as a climate-resilient energy asset and an appealing investment opportunity.

“Using natural capital valuation approaches can inform decision-making on the design and financing of green, resilient infrastructure projects in Africa,” said John Maughan, Co-Chair of the NC4-ADF initiative and Research Programme Manager at GGKP. “It is on this basis that the initiative is undertaking four case studies on mainstreaming natural capital approaches in Tanzania as well as Nigeria, Madagascar and Mozambique.”

The initiative aims to gather best practices and explore business cases of integrating natural capital in the operation of development finance institutions and multilateral development banks.

- Natural Capital for African Development Finance (NC4-ADF)

- Mainstreaming natural capital in African development finance

- Launch of the Natural Capital for African Development Finance (NC4-ADF) programme

Advancing the knowledge frontier

The GGKP Expert Group on Natural Capital expanded in 2021 its methodology and assessed financial investment needs to fill the estimated natural capital gaps in 10 countries – from least-developed to high-income ones. According to the assessment, additional costs needed to meet selected Sustainable Development Goal (SDG) targets were estimated at $774 billion per year in global private and public investment. Land remediation techniques showed the highest benefit-to-cost ratio; for every $1 spent on land remediation, $391 would be generated in natural capital benefits.

The GGKP Expert Group on Natural Capital expanded in 2021 its methodology and assessed financial investment needs to fill the estimated natural capital gaps in 10 countries – from least-developed to high-income ones. According to the assessment, additional costs needed to meet selected Sustainable Development Goal (SDG) targets were estimated at $774 billion per year in global private and public investment. Land remediation techniques showed the highest benefit-to-cost ratio; for every $1 spent on land remediation, $391 would be generated in natural capital benefits.

In the latter half of 2021, the expert group included 10 additional countries to generate results for a total of 20 countries, covering 54% of world gross domestic product (GDP) and 39% of the global land area. These 20 countries also include 11 sub-Saharan Africa countries, which results in covering more than 70% of sub-Saharan African GDP.

A report by the expert group showed that climate change, air quality and protected areas were the top three sectors that require the highest expenditures to meet the SDG targets for the set of 20 countries. The results also underlined that the greatest natural capital net gains would come from meeting the targets for forests, wetlands and all protected areas, which make up half of all net benefits.

“Across sub-Saharan Africa, the gains of natural capital as a per cent of the estimated current stock of natural capital were especially large as well as in some other parts of the developing world,” noted Anil Markandya, a member of the GGKP Natural Capital Expert Group and lead author of the paper.

In 2022, the group will produce an advocacy piece focusing on the African continent with the key results on the 11 sub-Saharan African countries and Morocco. The piece will provide best practice guidance to governments and regional stakeholders who are conducting independent assessments on the SDGs. In addition, a GGKP flagship report on global natural capital gap will be produced in time for Stockholm +50 to provide national, regional and global recommendations in prioritizing natural capital investment as well as methodological guidance on the application. The results will include estimates with 20 additional countries, and cover over 90% of global GDP and the majority of the world’s population and land mass.

- Assessing countries' financial needs to meet the SDGs through natural capital investment

- The natural capital gap and the SDGs: Costs and benefits of meeting the targets in 20 countries

- Plugging the natural capital financing gap to meet the SDGs

Moving towards knowledge application

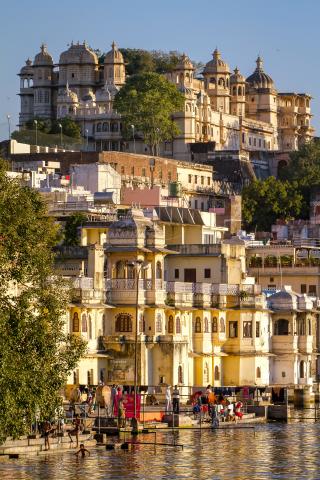

In collaboration with the Economics of Land Degradation (ELD) initiative and in-country partners, the GGKP Expert Group on Natural Capital completed in 2021 three pilot tests each in India, Kyrgyzstan and Rwanda, which focused on achieving green growth through terrestrial natural capital restoration.

In collaboration with the Economics of Land Degradation (ELD) initiative and in-country partners, the GGKP Expert Group on Natural Capital completed in 2021 three pilot tests each in India, Kyrgyzstan and Rwanda, which focused on achieving green growth through terrestrial natural capital restoration.

The pilot testing in Madhya Pradesh, India, especially demonstrated how land remediation interventions brought about environmental, social and human capital benefits, while addressing seven SDGs and 15 national targets. This exemplary ground-test case helped develop a toolkit, which could encourage regional replication of the methodology within and beyond the pilot site.

Also in 2021, a study on the Kakono Hydropower Plant in Tanzania that was finalized in July shed light on the trade-offs for policymakers and development finance decision-makers, such as AfDB, when investing in similar large-scale infrastructure projects. Using IISD’s Sustainable Asset Valuation (SAVi) methodology, the study measured the environmental, social and economic externalities of the hydropower plant and financial performance implications mainly in relation to the climate change risk factors.

In collaboration with partners, groundwork for similar natural capital assessments for AfDB projects on developing agro-industry zones in Madagascar and Mozambique was also done this year. Results from these assessments will feed into building strong business cases of natural capital approaches in African development finance in 2022.

The expert group will also apply in 2022 the natural capital gap methodology in three African countries – Cameroon, Mauritania and Nigeria – that have semi-dry land, forest ecosystems and a marine and coastal environment. Linkages between the natural capital gap methodology and the System of Environmental-Economic Accounting (SEEA) Ecosystem Accounts of the UK are also being explored to provide methodological insights on using data generated from ecosystem accounts at national level.

“Key insights from these concrete in-country application cases will help improve the methodology to build a major policy advocacy piece on natural capital investment in achieving nature-related SDG targets,” said Sun Cho, GGKP Country Engagement Coordinator.

- Economics of Land Degradation: Evaluating the Impact of Land Remediation through the Lenses of Natural Capital and SDGs in the Bundelkhand Region in Madhya Pradesh, India

- A Sustainable Asset Valuation of the Kakono Hydropower Plant in Tanzania

- Natural capital approaches to AfDB infrastructure financing projects in Madagascar and Mozambique

Expanding new partnerships

The GGKP Expert Group on Natural Capital continues to establish new partnerships in Africa and beyond through collaborations with different partners.

A technical working group on African development finance was established under the African Natural Capital Accounting (NCA) Community of Practice (CoP) to support the natural capital mainstreaming in development finance through the application of NCA data and methods. In the inaugural meeting held in November 2021, committed NCA and development finance experts in the region identified clear priority and expected outcomes of the group.

County offices of AfDB, WWF and German development agency (GIZ) are now onboard to co-create knowledge application cases of natural capital approaches in pilot countries in Africa. International non-profit institutions and multilateral development banks working on natural capital and inclusive wealth have also joined or expressed their interest in building partnerships with the GGKP.

The Green Forum, an online interactive community space, is serving as an effective medium to facilitate active discussions and knowledge sharing on mainstreaming of natural capital. Responding to the new realities of post-COVID project planning, an online version of the GGKP Natural Capital Expert Group was created under this online space and it offers more inclusive and open expert community discussions.

Sharing and managing knowledge on natural capital

The Economics of Biodiversity: The Dasgupta Review, launched in February 2021, called for improvements to economic accounting in order to recognize the value of natural assets and progressively move towards measuring inclusive wealth. A GGKP webinar, co-hosted by the United Kingdom’s Office of National Statistics (ONS) and the Economic Statistics Working Group (ESWG) on 30 March, discussed the review and focused on issues concerning the measurement of natural capital. In the following day, there was also an expert workshop – Data after Dasgupta: Achievements, knowledge gaps and future actions – that reflected on recent achievements in the natural capital field, including the adoption of SEEA Ecosystem Accounting as an international standard and identified possible ways to fill gaps on natural capital data supply and demand.

The Economics of Biodiversity: The Dasgupta Review, launched in February 2021, called for improvements to economic accounting in order to recognize the value of natural assets and progressively move towards measuring inclusive wealth. A GGKP webinar, co-hosted by the United Kingdom’s Office of National Statistics (ONS) and the Economic Statistics Working Group (ESWG) on 30 March, discussed the review and focused on issues concerning the measurement of natural capital. In the following day, there was also an expert workshop – Data after Dasgupta: Achievements, knowledge gaps and future actions – that reflected on recent achievements in the natural capital field, including the adoption of SEEA Ecosystem Accounting as an international standard and identified possible ways to fill gaps on natural capital data supply and demand.

“We are making excessive demand on the biosphere goods and services so much that the biosphere stock, whether it is measured in terms of quality or quantity, is shrinking”, said Sir Partha Dasgupta, Professor of Economics at the University of Cambridge and lead author of the report. “We do need a mental model at least and a formal mathematical model at best. And inclusive wealth which is a measure of stock to measure the accounting value of produced capital, human capital, and natural capital may enable capital measuring.”

On 6 July 2021, another GGKP webinar – Closing the Financing Gap: Investing in Natural Capital to Achieve the SDGs – outlined solutions to plug a global natural capital investment gap to achieve the SDGs by 2030, and discussed how governments and the private sector can value the risks and identify the financing opportunities for enhancing natural capital and building sustainable economic growth, particularly during this strained time of recovery from the COVID-19 pandemic.

- Taking a natural capital approach to economic decision-making

- Looking for policy solutions to plug the natural capital investment gap

Mainstreaming natural capital in a COVID-19 world

In the wake of the COVID-19 pandemic, the importance of mainstreaming natural capital in all aspects of the decision-making process is stronger than ever. The GGKP and the Expert Group on Natural Capital have been supporting a series of knowledge-sharing and management activities on identifying and strengthening the roles of natural capital in achieving green recovery and building back better.

In the wake of the COVID-19 pandemic, the importance of mainstreaming natural capital in all aspects of the decision-making process is stronger than ever. The GGKP and the Expert Group on Natural Capital have been supporting a series of knowledge-sharing and management activities on identifying and strengthening the roles of natural capital in achieving green recovery and building back better.

This includes a webinar series on “Mainstreaming Natural Capital in Africa’s Post-COVID19 Development Agenda” under the NC4-ADF initiative. The first session was organized on 8 December 2021 with an aim to activate the African Union’s Green Recovery Action Plans in Africa through natural capital approaches. Panelists shared ideas on how natural capital-rich continent can benefit the most from linking the plan with nature-based solutions, which could provide a win-win solution of tackling climate change and providing direct technical advisory services to the government on the reporting and revision of the Nationally Determined Contributions (NDCs).

The series will continue in 2022 to bring more knowledge and generate new perspectives on embedding natural capital approaches in the national and regional green recovery plans.