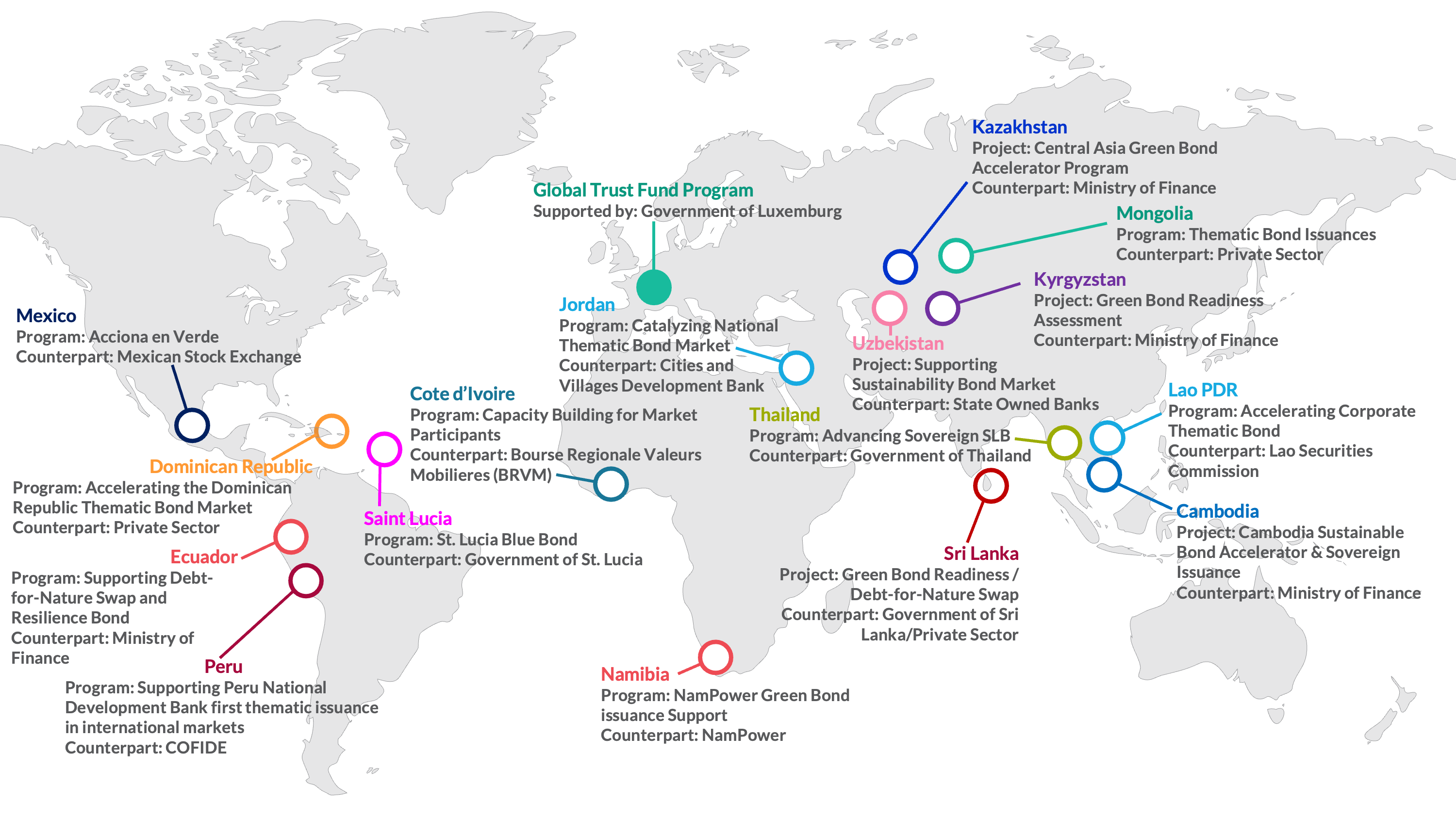

GGGI’s Global Trust Fund has a portfolio of thematic bonds in the following countries.

(as of January 2025)

In 2020, the Southeast Asian region recorded robust economic growth with a combined GDP of $3.11 trillion and a remarkable average GDP growth of 5% since 2015, making it one of the fastest-growing regions in the world. Green bond issuance increased by 11%, reaching a record $12.8 billion, underlining the region's commitment to sustainable finance. However, social and sustainability bonds make up only a small part of the global bond market, accounting for just 5% in Asia-Pacific and 1% globally in 2020. Cambodia, Lao PDR and Vietnam have not yet issued bonds with a sustainability or social label.

GGGI's strong presence in Southeast Asian countries puts GGGI in a position to make a significant impact. By working with key institutions such as the Asian Development Bank, The United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), regional central banks, the Climate Bonds Initiative, the ASEAN Secretariat, and other strategic partners, GGGI aims to advance in this important initiative.

Latin America and the Caribbean (LAC)

In the Latin America and the Caribbean region, green bond issues account for 3.5% of the global total, with the Caribbean contributing only 0.4%. Despite the relatively low volume, the region recorded the fastest year-on-year growth globally, reaching a volume of $16.3 billion in 2020 — a remarkable 82% increase from $8.9 billion in 2019. While Brazil and Chile dominate with 60% of issuance, green government bonds were only issued by Chile, Colombia, Mexico, and Peru.

GGGI plays a central role in this burgeoning market and receives requests for sustainable financing from governments, national development banks, stock exchanges and private sector issuers. These enquiries are primarily focused on innovative green bonds, such as blue sustainability bonds and sustainability and resilience labels, which demonstrate a commitment to pushing the boundaries of traditional green finance.

In Africa, the market for thematic bonds is still in its infancy and accounts for less than 1% of the global market. Pioneers are Morocco, Nigeria, South Africa, Namibia, and the Seychelles, with the West African Development Bank issuing Africa's first sustainability bond. Although cumulative green bond issuance is only $4.3 billion, there is a huge opportunity for the region in the broader sustainable finance market.

GGGI is actively working with its African members, particularly Côte d’Ivoire, Rwanda, Senegal, and Uganda, which have expressed interest in green sovereign bonds. The organization works with strategic institutions such as the African Finance Corporation, the Banque Ouest Africaine de Developpement (BOAD) and the Economic Community of West African States (ECOWAS) Bank for Investment and Development, which are working on blended finance facilities focused on the climate change mitigation and adaptation sectors. GGGI is supporting the Senegalese government in issuing green sovereign bonds that are aligned with the country's NDC targets. Taken together, these efforts demonstrate GGGI's commitment to advancing green finance and sustainable development across the African continent.